Protect Your Retirement with a Gold IRA

Allenhouse Metals makes it easy to open a self-directed IRA backed by gold coins and bars. Our simple process gets you started fast.

What Is A Gold IRA?

A self-directed gold IRA lets you invest in physical gold, hedging against inflation as gold prices typically counter paper asset trends. This IRA offers tax deferral benefits and potential capital gains tax exemptions. Reach out to our team now to explore gold IRA rollover options and secure your financial future.

Why Invest in a Gold IRA?

A Gold IRA offers a powerful way to diversify your portfolio—especially when traditional markets stumble. Gold has a long history of gaining value during downturns and even thriving in strong economies. In fact, over the past 20 years, gold has surged more than 400%.

Unlike stocks, bonds, or foreign currencies, gold is a tangible asset—something you can physically hold. By investing in a Gold IRA, you’re not just planning for retirement, you’re anchoring your future with real, lasting value.

Diversification

Central banks and billionaires have gold in their portfolio as it increases the value of money and provides an added security through diversification of assets.

Global Currency

From central banks to individual investors, demand for physical metals is higher than ever. That rising demand, and occasional supply limits, support long-term value and scarcity.

A True Safe Haven

As the cost of living rises, so does the value of precious metals. Gold and silver help preserve your purchasing power and provide a natural hedge when inflation eats away at traditional savings.

Protect Against Inflation

Precious Metals increase in value over time, keeping pace with the cost of living. While stocks often decline, metals offer a reliable ‘hedge’ against inflation and are a proven strategy for Preserving Purchasing Power.

Stronger Than the Dollar

The USD and Precious Metals share an inverse relationship. Since 1913, gold has maintained its purchasing power, and buys all the same goods and services, while the USD has lost 95% of its value. No other currency offers the same level of protection and stability as Gold.

Physical Demand

Central banks are major buyers of precious metals, driving global demand for physical gold bars and coins. Since the 2008 financial crisis, demand has surged, with some of the world’s largest government mints, like the United States restricting sales due to record-breaking interest.

Why Gold Remains the Ultimate Inflation Shield

Historically, gold’s value tends to rise as the dollar weakens. By investing in gold now, you’re positioning yourself for potential wealth growth in the coming years. This inverse relationship offers a unique opportunity to expand your net worth over time. Reach out to Allenhouse Metals today to explore opening a gold IRA account and secure your financial future.

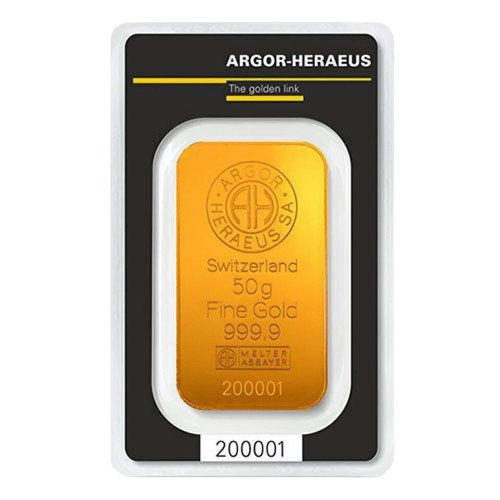

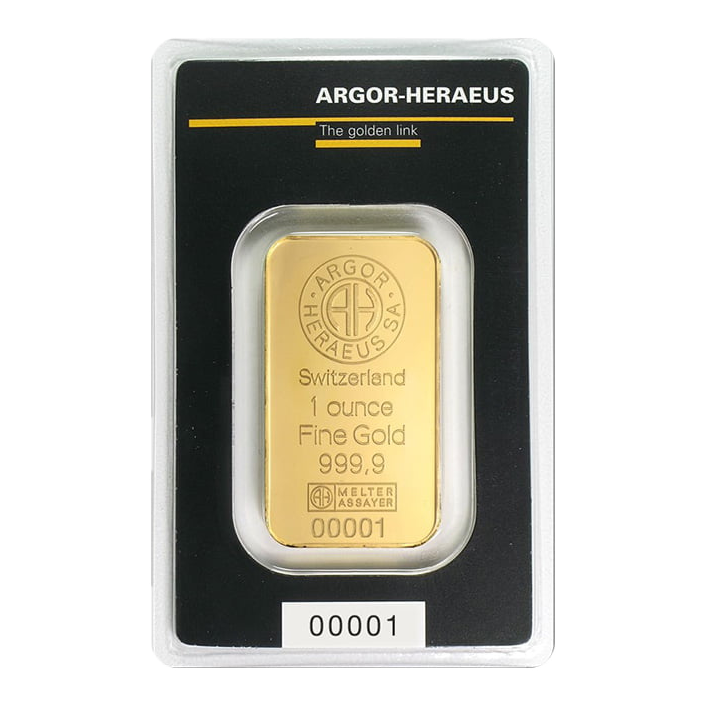

Purity Standards For IRA Gold

Gold IRA investments must be .9950 pure. Gold bullion bars should be fabricated by LBMA, NYMEX, COMEX or any other ISO 9000 approved refiner. Proof gold coins should be presented with a certificate of authenticity and must be in their original mint packaging. All gold bullion must be in an uncirculated, first-rate condition.

Tax Advantages of a Gold IRA

Gold-backed IRAs—whether Roth or Traditional—offer powerful tax benefits while helping protect your retirement from market volatility.

With a Roth Gold IRA, you pay taxes on contributions up front, but your gains grow tax-free—and you won’t owe taxes when you withdraw in retirement.

A Traditional Gold IRA allows you to deduct contributions in the year they’re made, lowering your taxable income. Your investment then grows tax-deferred, and you’ll only pay taxes when you begin withdrawals—potentially at a lower tax rate.

After the 2008–2009 crash, many investors turned to physical gold in IRAs to safeguard their savings from future downturns. Today, that strategy is more relevant than ever.

Investment Grade Gold Products (IRS Approved)

Competitive Pricing

Fast, Free Shipping on Qualifying Orders

Secure Storage Options

Take Control of Your Retirement Portfolio

We’ll help you open a self-directed IRA, connect with a trusted custodian, and choose metals that fit your goals.