Invest in Silver. Strengthen Your Future.

A Silver IRA helps diversify your portfolio and guard against inflation. Start growing your wealth today.

What Is A Silver IRA?

A Silver Individual Retirement Account allows you to invest in physical silver, and serves as a good hedge against inflation by having a tangible asset in your portfolio.

Why Buy Silver?

Silver offers a smart way to diversify your portfolio, especially when markets are uncertain. Known for both its industrial demand and investment appeal, silver has shown strong long-term growth and resilience.

Unlike stocks or bonds, silver is a tangible asset you can hold. With a Silver IRA, you’re not just saving for retirementm, you’re investing in real, physical wealth with lasting value.

Industrial Demand Is Surging

Silver is critical to renewable energy and tech, thanks to its unmatched conductivity, it's becoming as essential as oil once was.

Rising Global Usage

From central banks to individual investors, demand for physical metals is higher than ever. That rising demand, and occasional supply limits, support long-term value and scarcity.

High Growth Potential

Silver remains undervalued compared to gold. The historic gold-to-silver ratio signals room for major upside.

Simple to Own

With a Silver IRA, owning and managing silver is straightforward and secure—no experience required.

No Counterparty Risk

Silver is a physical asset, not a promise on paper. It can’t default, disappear, or go bankrupt.

Limited Global Supply

Silver is being consumed faster than it’s replaced. Even reclaimed sources can’t keep up with demand.

Silver Is The Future of Energy

One reason silver makes an excellent investment is the role that it is playing in the “green” revolution, specifically in the renewable energy sector.

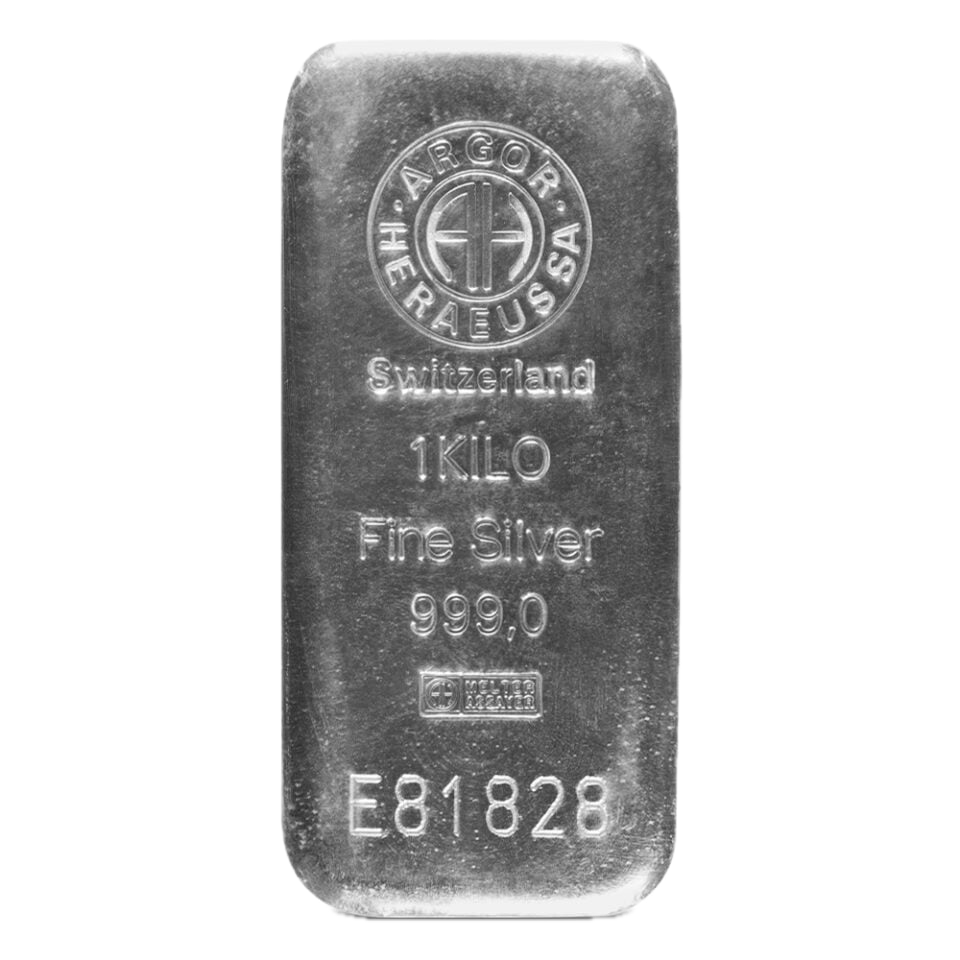

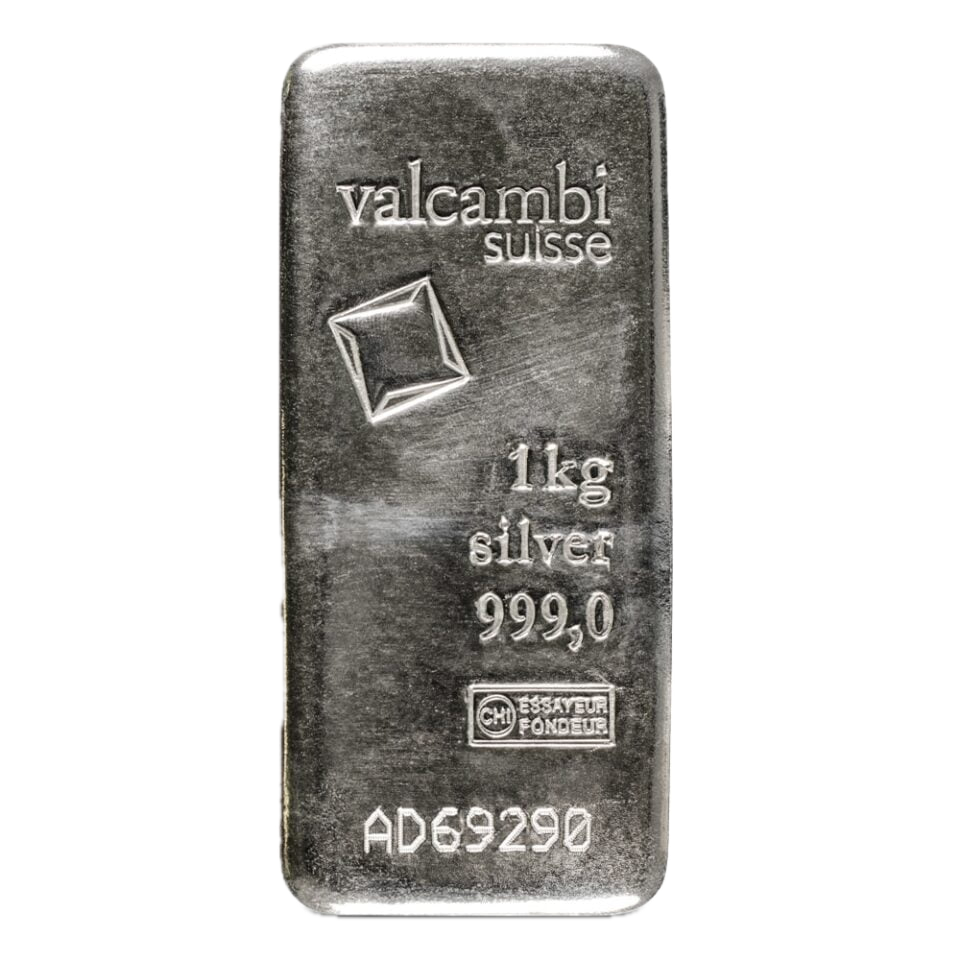

Purity Standards For IRA Silver

Silver must be .999%+ pure. Bullion bars should be fabricated by LBMA, NYMEX, COMEX or any other ISO 9000 approved refiner. Proof coins should be presented with a certificate of authenticity and must be in their original mint packaging.All bullion must be in an uncirculated, first-rate condition.

Tax Advantages of a Silver IRA

Investing in a silver-backed IRA offers powerful tax benefits—whether you choose a Roth or Traditional account.

With a Roth Silver IRA, you pay taxes on your contributions now, but your gains grow tax-free. That means you won’t owe a dime in taxes when you withdraw in retirement.

A Traditional Silver IRA lets you deduct contributions upfront, lowering your taxable income for the year. Your investment then grows tax-deferred, and you’ll only pay taxes when you begin withdrawals, potentially at a lower rate in retirement.

Since the 2008–2009 financial crisis, more investors have turned to physical silver in IRAs as a safeguard against future market crashes. For those looking to protect and grow their retirement savings, silver offers both security and long-term value.

Investment Grade Silver Products (IRS Approved)

Competitive Pricing

Fast, Free Shipping on Qualifying Orders

Secure Storage Options

Take Control of Your Retirement Portfolio

We’ll help you open a self-directed IRA, connect with a trusted custodian, and choose metals that fit your goals.